Client Alert: Gov. Newsom Signs A.B. 150 – SALT Workaround

Gov. Gavin Newsom signed A.B. 150 into law on July 15, 2021. This law creates a workaround to the $10,000 cap on a federal income tax deduction for state and local taxes (“SALT”). The law was unanimously approved by the California Assembly and Senate on July 1, 2021 and enacted as a part of California’s 2021-22 budget. It is expected that the California Franchise Tax Board (“FTB”) will provide further guidance on how this new law will be implemented and administered.

California’s SALT workaround is an elective entity level tax available to qualifying pass-through entities. An eligible entity that elects in to the tax will pay a 9.3% tax on its taxable income and the pass-through owners then receive a tax credit to be applied to their personal California income tax. For federal income tax purposes, the entity level tax reduces the pass-through’s net income, which in turn reduces the net income of the pass-through owners on their federal income tax returns.

The entities eligible for this SALT workaround are partnerships or S corporations whose owners are individuals, fiduciaries, estates, trusts or corporations (i.e. a partnership cannot be a partner). Additionally, the SALT workaround is not available to publicly traded partnerships or an entity that is part of a California combined reporting group.

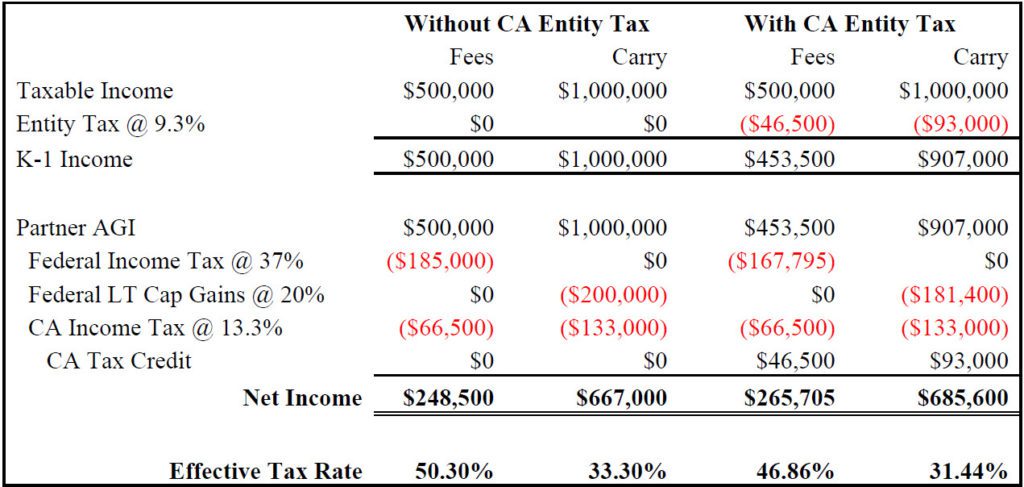

Investment advisors earning both ordinary income on management and performance fees, and long term capital gains on carried interest and invested capital should evaluate whether these income sources could benefit from the California SALT workaround. If structured properly, fund managers could save over 3% in federal income tax on ordinary income and over 1.5% on federal income tax on long-term capital gains. The example below provides a simple illustration of a fund manager earning $500,000 in fee income and $1,000,000 in carried interest and assumes all income is taxed at the highest applicable marginal rate. The first two columns reflect the net income to a fund manager that does not take advantage of the SALT workaround versus the latter two columns reflecting net income after application of the SALT workaround. The actual savings will depend on a taxpayer’s individual situation.

The FTB has yet to provide guidance on how this SALT workaround will be implemented, but taxpayers should begin evaluating their income sources to evaluate whether they may be able to take advantage of this SALT workaround. Additionally, the IRS has indicated that certain entity level state taxes can reduce a taxpayer’s federal taxable income, but the IRS’ guidance on the topic and how it applies to all income classifications is incomplete. This summary represents only a high level overview of the new law. For further information on the new SALT workaround, how it may apply to you, and related planning, please contact any member of the Tax group: Rafi W. Mottahedeh, Dashiell C. Shapiro and Mark E. Mullin.