Opportunity Zones

Our clients have expressed significant interest in the new “Qualified Opportunity Zone” (“Qualified Zone”) tax incentives created by The Tax Cuts and Jobs Act of 2017 under Subchapter Z of the Internal Revenue Code (“Subchapter Z”). These incentives encourage the formation of “Qualified Opportunity Funds” (“QOFs”) to invest in operating businesses and real estate developments in Qualified Zones. We believe that real estate developers and real estate fund managers as well as private equity investors will find the QOFs an interesting way to raise capital for investment opportunities in Qualified Zones over the next several years. As noted below, however, it remains unclear whether a QOF will be appropriate to invest in a variety of different businesses and properties located in Qualified Zones or in only one opportunity.

Shartsis Friese LLP represents hundreds of investment advisers and investment fund managers, and we offer top tier and comprehensive fund formation, tax and real estate transactional practices. We have extensive experience in the areas of forming private equity and real estate funds, as well as real estate acquisition, disposition, development, negotiating real estate joint ventures and mortgage and mezzanine loans. Our extensive knowledge in these areas allow us to effectively and efficiently navigate the complex QOF rules, and the acquisition, ownership, development, operation and financing of Qualified Zone properties.

Overview. The federal tax incentives for QOFs to invest in Qualified Zones business opportunities include:

- Significant tax deferral of capital gains re-invested in QOFs within 180 days following the disposition of appreciated property (“Rollover Gains”);

- Exclusion from tax of up to 15% of those Rollover Gains, and

- Complete exclusion of tax on the appreciation of Rollover Gains re-invested and held in a QOF for at least 10 years.

On October 19, 2018, the IRS released the first set of proposed regulations for Subchapter Z (the “Proposed Regulations”) and the related Revenue Ruling 2018-29 (the “Revenue Ruling”). These cleared up many of the industry’s questions regarding Subchapter Z, but additional regulations and guidance are expected to be published in the near future. The IRS is currently seeking comments on the Proposed Regulations; however, taxpayers may rely on them prior to the publication of the final regulations if the rules are applied in their entirety and in a consistent manner.

The tax benefits derived from QOFs will only apply to an investor’s federal income tax liability. The timing and amount of state and local tax on capital gain recognized by QOF investors will depend on each state’s response to Subchapter Z.

Definitions

Qualified Opportunity Zones (“Qualified Zones”) are census tracts designated by each state and various U.S. territories consisting of (1) certain low-income communities and (2) certain areas that are contiguous with low-income communities designated as Qualified Zones. All Qualified Zones have now been designated, and maps identifying them are readily available online.[1]

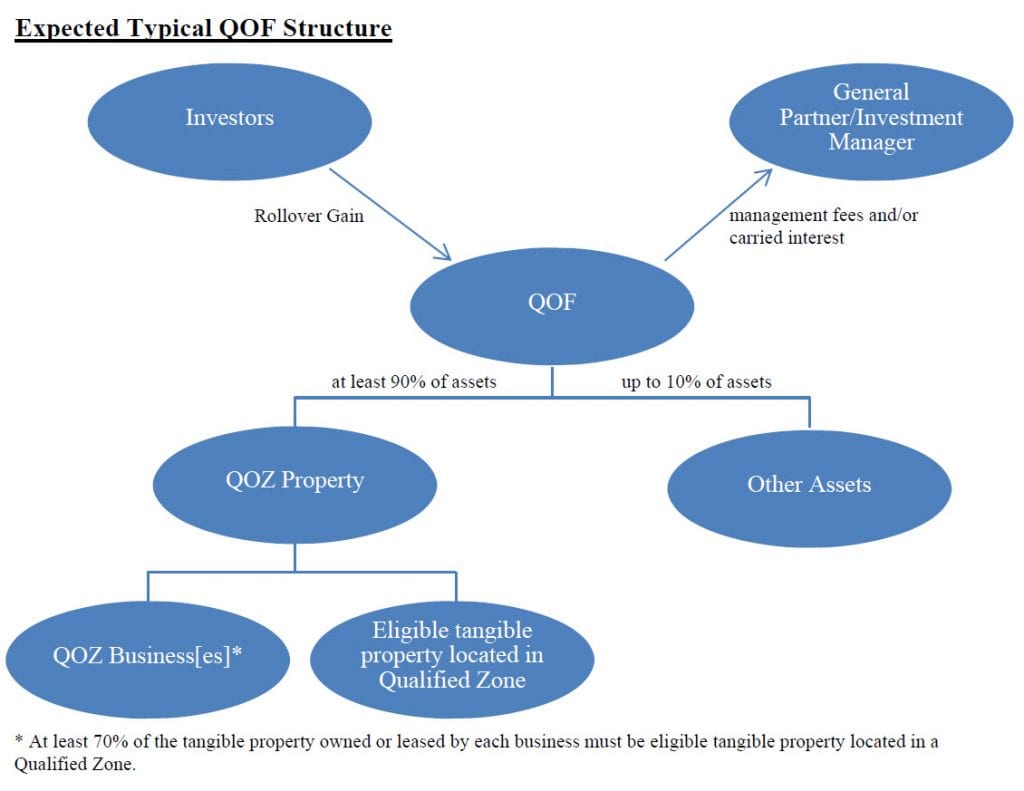

Qualified Opportunity Funds (“QOFs”) are entities treated as partnerships or corporations for tax purposes that are organized to invest in Qualified Zones. Limited partnerships and LLCs, the most commonly-used type of entities, both can qualify as Qualified Zones (if treated as partnerships or corporations for tax purposes). An entity must invest at least 90% of its assets in “qualified opportunity zone property” (“QOZ Property”) to qualify as a QOF. QOZ Property consists of (1) stock or partnership interests in a QOZ Business (defined below) and (2) direct investments in tangible property (such as real estate) located in a Qualified Zone that was purchased by the QOF after December 31, 2017, and is used in that QOF’s trade or business; provided that the “original use” of that property must begin with the QOF, or the QOF must “substantially improve” that property. A QOF is treated as substantially improving property only if, during any 30-month period, it makes capital expenditures that exceed the adjusted basis of that property at the beginning of that period.

The Proposed Regulations and the Revenue Ruling clarify that to determine whether a QOF is “substantially improving” real property, the adjusted basis of a purchased building does not include the cost associated with purchasing the land. The QOF is not required to separately improve the land. For example, a QOF that acquires a property for $100,000 and attributes $80,000 of the cost to the land and $20,000 to the building would only need to spend more than $20,000 in improvements during a 30-month period for that property to be considered QOZ Property. These rules apply equally to QOZ Businesses that develop or operate real property.

A “QOZ Business” is a business in which (1) at least 70% of the tangible property owned or leased by that business was acquired after December 31, 2017 and is located in a Qualified Zone during substantially all of the business’ holding period of that property and (2) the original use of that tangible property either begins with the start of the business or is substantially improved by the business. A QOZ Business (a) must derive at least 50% of its total gross income from the active conduct of the business, (b) use a substantial portion of its intellectual property in the active conduct of the business, (c) hold less than 5% of the aggregate unadjusted bases of its property in “nonqualified financial property”, such as debt, stock, partnership interests, options, futures contracts, forward contracts, warrants, notional principal contracts, annuities, and other similar property and (d) cannot engage in certain activities, such as operating a golf course, country club, massage parlor, hot tub facility, suntan facility, gambling facility or liquor store. The Proposed Regulations do not define what constitutes the “active conduct” of a business for purposes of these gross income and intellectual property requirements, and the variety of businesses that may qualify as QOZ Business will depend in part on that definition.

The Proposed Regulations provide for a working capital safe harbor for QOZ Businesses to exclude cash, cash equivalents and debt instruments with a maximum term of 18 months from the definition of “nonqualified financial property,” as long as the QOZ Business has a written plan, including a schedule, for investing the assets in the acquisition, construction and/or substantial improvement of tangible property in a Qualified Zone and the QOZ Business actually invests those assets in a manner consistent with that plan. This safe harbor was intended to provide relief from the inflexibility of the requirement that QOFs must have 90% of their assets invested in QOZ Property at all times, but it remains unclear how the 90% asset test will operate with funds’ needs to hold cash reserves and maintain their own working capital accounts.

Tax Benefits

Tax Deferral on Rollover Gains. Gain from the sale of appreciated property is typically taxed in the year the property is disposed of, but Subchapter Z allows a QOF investor to exclude Rollover Gains in that year if re-invested in QOFs within 180 days following the disposition. Only the Rollover Gains (not the full disposition proceeds) need be reinvested to receive the tax deferral. Instead, the investor includes its Rollover Gains (to the extent that it is not excluded from taxation, as discussed below) in its gross income in the earlier of the year in which it disposes of its interest in the QOF or 2026. The Rollover Gain is taxed in the year of inclusion at the same rate it would have been taxed had it been included in the year of deferral. For example, the 20% current long-term capital gains rate would still apply to long-term capital gain deferred in 2018 even if the long-term capital gains rate in the year of inclusion had increased to 25%.

The Proposed Regulations explain that any taxpayer that is eligible to recognize capital gain can elect to defer that gain under Subchapter Z, including taxpayers allocated capital gain through a pass-through entity such as a partnership. The Proposed Regulations establish special rules for taxpayers that receive capital gain allocations through a pass-through entity with respect to the 180 day rollover period under Subchapter Z. If a partnership does not elect to defer eligible gain, the partners allocated that gain have 180 days from the last day of the partnership’s taxable year to defer their distributive share of that gain under Subchapter Z. Partners may also elect to begin their 180 day period on the same day that the 180 day period begins for the partnership.

Exclusion of Rollover Gains. In addition to the deferral benefit, an investor that holds its QOF interest for at least 5 years can exclude 10% of its Rollover Gains from tax (15% if it holds its QOF interest for at least 7 years).

Exclusion of Gains on Invested Capital. A QOF investor that re-invests its Rollover Gains in the QOF for at least 10 years is not subject to federal income tax on any gains realized on a sale of its QOF interests attributable to that re-invested capital. Although investors are allowed to contribute new capital (i.e. non-Rollover Gain capital) to a QOF, the tax exclusion does not apply to gains from investments of new capital.

It was initially unclear if debt financed investments of a QOF structured as a partnership would impact an investor’s ability to take full advantage of the 10 year exclusion, but the Proposed Regulations clarify that such investments will not affect QOF investors.

The Proposed Regulations did not clarify whether an investor is deemed to have sold a portion of its QOF interests when a QOF that has multiple underlying investments sells one of those underlying investments. Thus, it is unclear whether such an investor would be able to exploit the 10 year exclusion in this circumstance. Additionally, it is unclear whether unrecognized capital gains committed, but not contributed, will be considered re-invested in a QOF for purposes of the tax deferral and/or exclusion benefits. Until further guidance is provided, it is likely that most QOFs will be structured to invest in only one opportunity.

Self-Certification and Deferral Election

Form 8996 was released in draft form concurrently with the Proposed Regulations. This form will be used by a QOF to certify that it is organized to invest in QOZ Property and will also be used to certify annually that the QOF held 90% of its assets in QOZ Property, as measured by taking the average percentage of QOZ Property held by the QOF on the last day of the first 6-month period of the QOF’s tax year and the last day of the QOF’s tax year. For new QOF’s the first 6-month period occurs 6 months after the QOF’s formation. For example, if a QOF was formed in April and its tax year ended in December, the 90% asset test for the first year would be measured by taking the average percentage of QOZ Property held by the QOF on the last day of September and December. Following the year of formation, the applicable months for the 90% asset test would be the last days of June and December. A new QOF that has 6 or fewer months remaining in its tax year will only be measured on the last day of its tax year. A penalty is imposed for each month that a QOF fails to meet the 90% asset test, but the tax liability for a QOF that falls out of compliance with the 90% asset test and does not intend to come back into compliance in the future is unclear.

Form 8949 will likely be used by taxpayers to make deferral elections under Subchapter Z. The form would be attached to the taxpayer’s federal income tax return for the taxable year in which the gain will be deferred. Form instructions relating to Subchapter Z deferral are expected to be released soon.

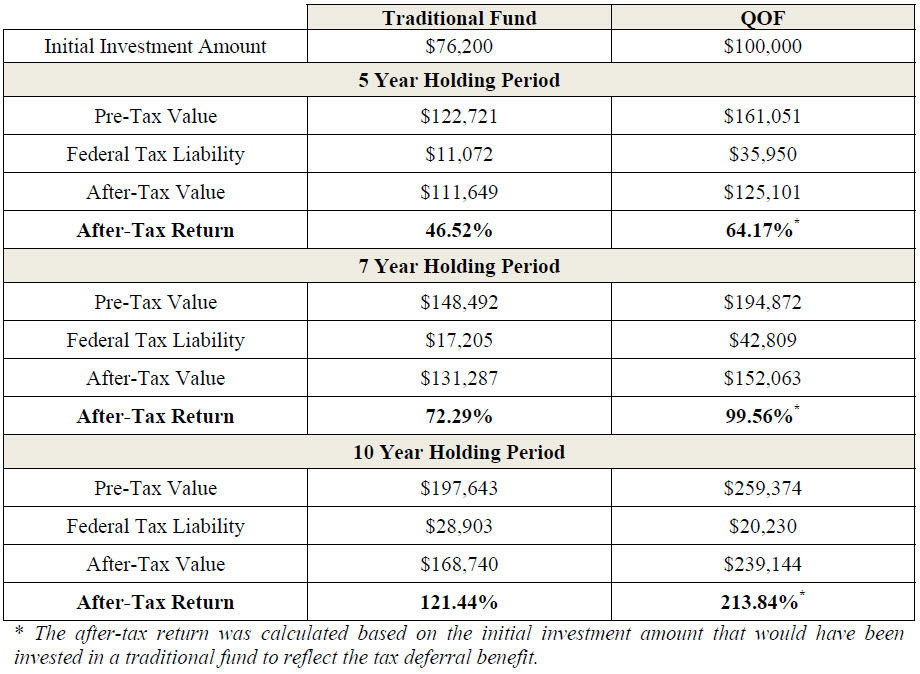

Example. The example below shows the potential benefits of investing $100,000 of Rollover Gains into a QOF. It assumes 10% growth compounded annually and a tax rate of 23.8% (i.e., the 20% current long-term federal capital gains rate plus the 3.8% federal net investment income tax). It does not account for state or local taxes.

More Information

If you have any questions or want to discuss QOFs, please contact one of the attorneys in the Investment Funds & Advisers Group at Shartsis Friese LLP: John Broadhurst, Carolyn Reiser, Jahan Raissi, Neil Koren, Jim Frolik, Christina Hamilton, Joan Grant or David Suozzi. David Egdal and Brad Curtis from the Real Estate Group at Shartsis Friese LLP are also available to answer questions and discuss QOFs.

Previous letters to our investment advisory clients and friends and discussions of other topics relevant to investment advisers and private investment funds can be found at our insights page: www.sflaw.com/blog/investment-funds-advisers-insights.

[1] A complete list of designated Qualified Zones can be found at https://www.irs.gov/irb/2018-28_IRB. A map of California’s Qualified Zones is available at http://dof.ca.gov/Forecasting/Demographics/opportunity_zones.